Unpaid overtime? Missed Meal breaks? Late Paychecks?

If your employer is cutting corners with your wages, EFLL will hold them accountable.

4.9 Overall Rating

10,000+

Clients Helped

$100M+

Recovered

Free Case Consultation within 24 hours

Don’t lose benefits due to delay. No-fee guarantee

Table of Contents

- Wage & Hour Violation Laws in California

- Off-the-Clock Work

- Missed Meal/Rest Breaks

- Misclassification of Employees

- Commission Disputes & Clawbacks

- Reimbursement & Expense Violations

- Wage Statement (Pay Stub) Violations

- Waiting Time Penalties

- PAGA Claims & Class Actions

- Unauthorized Payroll Deductions

- On-Call Time / Controlled Standby

- Travel Time Violations

- Piece Rate Missteps

- Commissioned Salespersons & Breaks

- Remote Work Violations

- Time Rounding

California has some of the most worker-friendly wage & hour laws in the nation

—but that doesn’t stop employers from violating them. Whether you’re paid hourly, salaried, by commission, or piece rate, you have the right to fair pay for every minute worked. At EFLL, we represent employees who’ve been underpaid, overworked, and illegally classified across all industries.

California Labor Code § 510 entitles most non-exempt employees to receive:

1.5x their Regular Rate of Pay

after 8 hours in a workday or 40 hours in a workweek

2x their Regular Rate of Pay

after 12 hours in a single workday or after 8 hours on the seventh consecutive workday

Despite these protections, unpaid overtime is one of the most common wage violations in California. Employers often try to avoid paying overtime by:

Misclassifying Employees

as salaried “exempt” when they don’t meet the duties test

Improperly Labeling Workers

as independent contractors who aren’t paid hourly

Failing to Track Hours Correctly

or forcing employees to work off the clock

Averaging Hours

across multiple weeks, which is illegal under California law

Paying Bonuses or Commissions

but not adjusting the regular rate of pay for overtime calculations

You may be entitled to recover not just unpaid overtime wages, but also:

Liquidated Damages

after 8 hours in a workday or 40 hours in a workweek

Interest & Penalties

under California law

Attorneys’ Fees & Costs

for bringing a successful claim

Off-the-Clock Work

Under California law, all time spent performing job duties must be paid. Off-the-clock violations include:

- Setting up or cleaning workstations before or after shifts

- Waiting for security checks, bag searches, or logging into systems

- Completing paperwork, checklists, or client calls after clocking out

Employers may tell workers to “just finish up real quick” without pay. That’s illegal. EFLL tracks down these unpaid minutes—and turns them into real compensation.

Missed Meal/Rest Breaks

California law provides strong protections for workers to ensure they receive uninterrupted time to rest and eat during their shifts. Under Labor Code §§ 226.7 and 512, employers are required to:

- Provide a 30-minute unpaid meal break before the end of the fifth hour of work

- Provide a second 30-minute meal break if the employee works more than 10 hours

- Authorize and permit a 10-minute paid rest break for every 4 hours worked or major fraction thereof (e.g., for a 6-hour shift, you should get one rest break; for 8+ hours, two)

Meal and rest break violations include:

- Requiring employees to remain on duty during breaks

- Interrupting or cutting short breaks for work tasks or calls

- Failing to provide a second meal break on long shifts

- Penalizing employees for taking lawful breaks

- Not providing breaks at all due to short staffing or pressure to meet quotas

If an employer fails to provide a compliant break, they owe the employee one hour of premium pay per day, per type of violation. That means if you miss both a meal and rest break in a single day, you’re owed two hours of additional pay.

Many employers also use automated systems that deduct breaks whether or not you actually took them. This results in widespread underpayment. At EFLL, we examine time records, punch logs, and internal policies to detect violations and recover every dollar you’re owed under California law

Misclassification of Employees

One of the most common wage violations in California is misclassifying employees as salaried “exempt” in order to avoid paying overtime, providing rest and meal breaks, or reimbursing business expenses. Under California Labor Code § 515 and the federal Fair Labor Standards Act (FLSA), to qualify as exempt, an employee must meet two key requirements:

1. The Salary Test

To be classified as exempt, an employee must earn a monthly salary equivalent to at least twice the state minimum wage for full-time work. This means:

- 2025: $66,560/year (based on $16.00/hr minimum wage)

- 2024: $64,480/year (based on $15.50/hr)

- 2023: $62,400/year (based on $15.00/hr)

- 2022: $58,240/year (based on $14.00/hr)

- 2021: $54,080/year (based on $13.00/hr)

If an employee is paid less than these amounts, they cannot be exempt, regardless of their job duties

2. The Duties Test

In addition to meeting the salary threshold, the employee must primarily perform exempt-level job duties. These include:

Executive

Managing a department or team, supervising 2+ employees, and having input on hiring/firing decisions

Administrative

Performing high-level office or non-manual work directly related to management or business operations, using discretion and independent judgment

Professional

Requiring advanced knowledge in a field of science or learning, typically acquired through specialized education (e.g., lawyers, doctors, CPAs)

If an employee spends most of their time on routine tasks, manual labor, or following directions rather than exercising judgment, they likely do not qualify as exempt.

Special Categories With Separate Salary Requirements

Some job roles have their own minimum pay thresholds and exemption rules, including:

Computer Software Professionals

Must be paid a minimum hourly rate ($55.58/hour in 2025) or meet an annual salary threshold ($115,763.35 in 2025) under Labor Code § 515.5

Licensed Physicians & Surgeons

Must earn a minimum of $101.22/hour in 2025 to qualify as exempt (Labor Code § 515.6)

Outside Salespersons

Exempt from overtime if they regularly work outside the employer’s place of business and sell products/services

At EFLL, we investigate your job duties, classification, and pay structure to determine whether you’ve been misclassified — and we fight to recover your unpaid wages, breaks, and penalties.

Commission Disputes & Clawbacks

Commission-based pay structures are common in industries like sales, real estate, finance, and tech—but they’re also commonly abused. Under California Labor Code § 2751, all commission agreements must be in writing and signed by both the employer and employee. Despite this requirement, employers frequently:

California law provides strong protections for workers to ensure they receive uninterrupted time to rest and eat during their shifts. Under Labor Code §§ 226.7 and 512, employers are required to:

- Provide a 30-minute unpaid meal break before the end of the fifth hour of work

- Provide a second 30-minute meal break if the employee works more than 10 hours

- Authorize and permit a 10-minute paid rest break for every 4 hours worked or major fraction thereof (e.g., for a 6-hour shift, you should get one rest break; for 8+ hours, two)

California law makes it clear: once you’ve earned a commission, your employer must pay it in full and on time. If they attempt to reclaim commissions or delay payments, they may be liable for wage violations, penalties, and interest. EFLL carefully reviews commission structures, employer communications, and payroll records to expose improper practices. We hold companies accountable for every earned commission withheld—especially when workers are pressured to generate revenue but denied fair compensation.

Reimbursement & Expense Violations

California Labor Code § 2802 requires employers to reimburse employees for all necessary expenditures incurred in the course of performing their duties. Common reimbursable expenses include:

- Mileage for work-related travel using a personal vehicle

- Cell phone and internet usage for remote work

- Uniforms, tools, or safety gear required for the job

- Home office equipment or software subscriptions

If your employer fails to reimburse you, you may be entitled to full repayment plus interest, penalties, and attorney’s fees. EFLL has helped employees recover thousands in unpaid expenses across industries including healthcare, retail, construction, and tech.

Wage Statement (Pay Stub) Violations

California Labor Code § 226 requires employers to provide accurate, itemized wage statements with every paycheck. Required information includes:

- Total hours worked

- Hourly rates and corresponding pay

- Gross and net wages

- Deductions and reimbursements

- Employer’s name and address

Common violations include missing hours, unreadable formatting, or pay stubs that don’t match actual hours worked. These errors may entitle employees to statutory penalties—even if wages were otherwise paid. EFLL performs pay stub audits and pursues full compensation.

Waiting Time Penalties

Under California Labor Code § 203, employers must pay all wages due immediately upon termination, or within 72 hours if the employee resigns without notice. If they fail to do so, employees may be entitled to:

- One full day's wages for each day the paycheck is late

- Up to a maximum of 30 days of penalties

This penalty is in addition to any unpaid wages. EFLL helps employees maximize recovery when employers delay final paychecks or try to avoid paying out vacation, commissions, or bonuses upon separation

PAGA Claims & Class Actions

The Private Attorneys General Act (PAGA) allows employees to file lawsuits on behalf of themselves and other aggrieved workers to enforce California Labor Code violations. PAGA claims are especially powerful when:

- A company has widespread payroll or break violations

- Misclassification affects large groups of workers

- Wage statement errors are systemic

Class actions and PAGA claims can result in substantial settlements and court-ordered reforms. EFLL has recovered millions in representative actions and has deep experience litigating complex labor violations

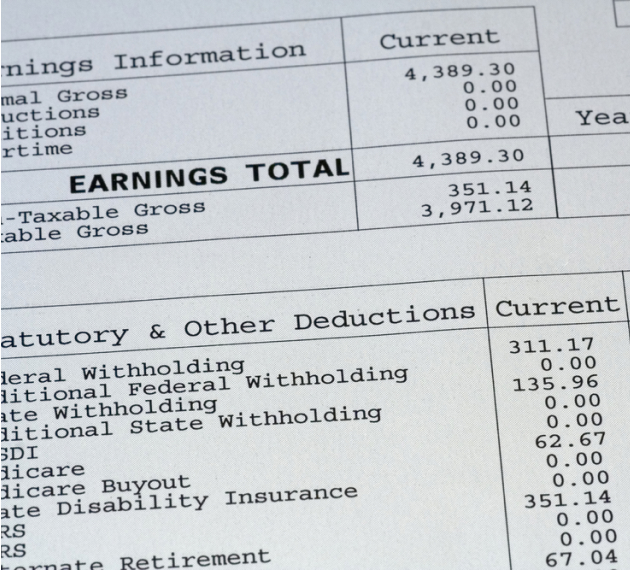

Unauthorized Payroll Deductions

California law prohibits employers from making unauthorized deductions from an employee’s paycheck. This includes:

- Charging for lost or damaged equipment

- Deducting uniform or tool costs

- Withholding money due to customer disputes or shortages

Labor Code § 221 and § 224 make clear that only lawful, pre-authorized deductions may be taken. EFLL helps recover unlawfully deducted wages and holds companies accountable for shifting business costs onto their workers.

On-Call Time / Controlled Standby

If your employer requires you to be on-call or in standby status, and imposes significant limitations on your ability to use that time freely, California law may consider that time compensable. This includes situations where you’re not actively working but cannot fully attend to personal matters. Examples of compensable standby time include:

Being Required to Remain On-site

during meal periods or breaks

Short Response Time Expectations

(e.g., reporting to work within 5–15 minutes)

Remaining in Uniform

or within a specific geographic area while waiting for calls

Restrictions on Personal Activities

like attending events, sleeping off-site, or consuming alcohol

Even when employees are technically “off the clock,” courts have found that these limitations on freedom can transform on-call time into paid work hours. In Mendiola v. CPS Security Solutions, Inc. (2015), the California Supreme Court held that security guards required to remain at a job site overnight were entitled to compensation for their standby time. Additional common violations include:

Security Checkpoint Delays

at entry/exit that aren’t counted

as paid time

Mandatory Boot-up or Login Time

for computers or POS systems

before clocking in

Pre-shift Meetings or Equipment Prep

while not clocked in

If your employer expects you to be ready to work, respond instantly, or limits your freedom during so-called “non-work” periods, they may owe you wages for that time. EFLL investigates on-call practices, security protocols, and shift prep policies to recover unpaid standby and setup time. EFLL helps employees recover wages for standby periods that go unpaid.

Travel Time Violations

Time spent traveling for work-related purposes must be paid under California and federal wage laws. This includes:

- Driving between job sites during a single shift

- Travel to and from off-site mandatory trainings or meetings

- Overnight or out-of-town travel for business (excluding regular commuting time)

In addition to paying for time, employers must reimburse mileage for employees who use their personal vehicles for work-related travel. Under California Labor Code § 2802 and IRS guidelines, the standard mileage reimbursement rates (per mile) have been:

- 2025: $0.67

- 2024: $0.67

- 2023: $0.655 (Jan–Jun), $0.655 (Jul–Dec)

- 2022: $0.585 (Jan–Jun), $0.625 (Jul–Dec)

- 2021: $0.56

These rates are updated annually by the IRS and serve as a benchmark for what qualifies as a reasonable reimbursement. Failure to reimburse mileage and compensate for travel time may result in wage violations and reimbursement claims under Labor Code § 2802. EFLL calculates unpaid travel hours and unreimbursed mileage, then pursues full recovery—including penalties, interest, and attorney’s fees.

Piece Rate Missteps

Employers who pay workers based on the number of tasks completed or units produced must still comply with California wage and hour laws. Violations include:

- Failing to separately compensate for rest and recovery periods

- Not tracking actual hours worked

- Underpaying for overtime despite high productivity

Labor Code § 226.2 requires employers to break out rest time pay on wage statements and to ensure hourly compliance. EFLL aggressively enforces compliance for agricultural workers, auto techs, and anyone paid by piece.

Commissioned Salespersons & Breaks

Commission-based compensation does not exempt an employee from California’s wage and hour protections. Many sales employees are misled into believing that because they earn commissions, they are not entitled to breaks or overtime—this is false unless a narrow exemption under Wage Order 7 or 4 applies.

Commissioned employees are still entitled to:

- Paid 10-minute rest breaks for every 4 hours worked

- Uninterrupted 30-minute meal breaks before the 5th hour of work

- Overtime pay if they are non-exempt, even if their earnings are variable

Common violations in sales environments include:

- Failing to track hours worked and break times

- Pressuring salespeople to eat at their desks or take calls during breaks

- Automatically assuming exemption without analyzing duties or base compensation

- Mislabeling non-exempt commissioned employees as exempt under outdated or incorrect exemptions

One of the most common examples is car salespersons, who are often misclassified as exempt simply because they

earn commissions. However, car dealership employees frequently work long hours, face immense pressure to skip breaks, and

are not always paid overtime or given proper wage statements. While some auto sales roles may qualify under narrow exemptions,

many salespeople do not meet all three criteria required to lawfully avoid overtime:

Work in a retail or service establishment;

Earn more than 1.5x the minimum wage;

Receive more than half of their compensation from commissions

Even if all three conditions are met, meal and rest break laws still apply. Employers who fail to provide compliant breaks must pay one hour of premium pay per day, per violation under Labor Code § 226.7. EFLL ensures that commissioned employees—including car salespeople and other retail-based earners—aren’t cheated out of their rights just because their pay is tied to performance. We investigate timekeeping systems, commission structures, and compliance with break laws—and fight for full compensation and penalties when violations occur.

Remote Work Violations

Remote workers are protected by the same wage and hour laws as in-office employees. Common remote work violations include:

- Unpaid overtime due to vague schedules

- Off-the-clock work like responding to emails or logging hours outside systems

- Denial of expense reimbursement (e.g., internet, phone, ergonomic equipment)

- Failure to provide meal/rest break opportunities

California Labor Code § 2802 requires reimbursement for remote work expenses, and all hours worked must be tracked and paid. EFLL helps remote workers document violations and demand justice.

TIME ROUNDING: EVIDENCE OF WAGE VIOLATIONS

Time rounding is usually evidence of wage and hour violations in California, especially when it results in underpayment of wages. Employers are required to pay employees for every minute worked —and modern timekeeping systems leave no excuse for rounding away wages.

- Rounding that consistently favors the employer is illegal

- Employers must track and pay for all time actually worked

- No time is too small to count under California law

In Camp v. Home Depot U.S.A., Inc. (2022) 84 Cal.App.5th 638, the Court of Appeal made it clear: “There is no regulatory de minimis rule in California wage and hour law.”

At EFLL, we dig into electronic time records to uncover patterns of wage theft masked by unlawful rounding practices. If your employer is shaving time off your paycheck—even just a few minutes a day—you may be owed substantial back pay.

Don’t Let Wage Theft Go Unchallenged

EFLL has recovered millions for California workers across nearly every industry. Whether you’re missing hours, underpaid commissions, or denied rest breaks, we’ll help you get what you’re owed.

READ OUR BLOG

Are You Being Paid Fairly? Know Your Wage Rights in California

Understanding your wage rights is crucial. This post breaks down California’s minimum wage laws, overtime rules, and common employer violations. Learn what to watch out for — and how to take action if you’re being shortchanged.

The Hidden Cost of Skipped Breaks: What California Law Says

Meal and rest breaks are legally required for most workers in California. This article explores what happens when employers fail to provide breaks and how employees can recover missed break penalties.

Got A Question?

We’ve Answers.

A violation occurs when an employer fails to pay the legal minimum wage, overtime, meal/rest breaks, or forces off-the-clock work. Misclassifying employees as independent contractors can also count.

In California, most employees are entitled to overtime pay at 1.5x their regular rate for hours worked over 8 per day or 40 per week. Double pay may apply in some cases.

Employers must provide a 30-minute unpaid meal break for every 5 hours worked and a 10-minute paid rest break for every 4 hours. Missed breaks may entitle you to extra pay.

Yes. You may file a wage claim with the California Labor Commissioner or take legal action. You may be entitled to back pay, penalties, and attorney fees.

In California, you generally have up to 3 years to file a wage claim, depending on the type of violation. Don’t wait — deadlines can impact your case.

Being salaried doesn’t automatically exempt you from overtime. Many salaried workers are still legally entitled to overtime pay based on their job duties.

Follow us on Instagram

View this profile on InstagramEmployees First Labor Law - Jonathan P. LaCour, Esq. (@employeesfirst) • Instagram photos and videos

Contact EFLL for Help Today

Are you missing overtime, breaks, or reimbursements? Learn how EFLL fights wage theft in California and recovers compensation for unpaid work. Free consults available.

Request A Free Consultation:

OFFICE LOCATIONS

EMPLOYEES FIRST LABOR LAW - LONG BEACH

- One World Trade Center, 8th Floor Long Beach, CA 90802